Sequestration Knife gets Sharpened

Sequestration Knife gets Sharpened

Geithner on Creating Crises

Italian Elections Scare Us All

- Fourth Quarter GDP Revised Up From -0.1% to 0.1%… The measure of overall U.S. production in the last quarter of 2012 was revised slightly higher, from a minimal loss to a minimal gain.

This means nothing… or everything, depending on how you look at it. A change of 0.2% means the underlying components like imports, government spending and inventories were slightly massaged. Who cares? But in the larger picture, this number speaks volumes. The best we can do is 0.1% growth? That’s what we got for another $85 billion in money printing? That’s what we got for a government that is borrowing $1 of every $3 it spends? I’m not sure how much more of this good news we can take.

- Fed Tells Market To Go Higher… In his prepared statements to Congress, Fed Chairman Ben Bernanke expressed concern that last week’s comments surrounding the possibility of less Fed intervention caused a selloff in the markets. This put in jeopardy bankster bonuses, lobbying dollars that have flowed to Washington, as well as his own credibility as a master economic magician able to levitate anything he wants. So Bernanke quashed any notion of an early exit… or really any exit at all… from QE. The markets promptly returned to the nosebleed section, based on nothing more than the words of a man with a printing press in his pocket. OK, the part about him being mad at the markets for moving lower is something I made up. I think. Sure seems likely though.

- Durable Goods Up 1.9%… The measure of the purchase of goods that last more than three years, less transportation (airplanes), increased by almost 2%.

Finally – a good, clean number! Durable goods are things like cars and washing machines. To see the purchase of such items rise is a good sign. To note that the U.S. manufacturing of such items is picking up at the same time is also a good sign. If you want to know where the action is, pull up a map of shale gas exploration and recovery. Rents are high, unemployment is low and car dealership sales are brisk in those areas.

- Chicago PMI Up From 55.6 to 56.8… The purchasing managers’ index for the Chicago region is well above neutral, which is 50. Managers indicated growth in orders as well as backorders.

Like the durable goods figure, this is a positive sign. What must be remembered about PMI indices is that they are diffusion indices. These numbers represent how many purchasing managers are answering questions positively or negatively about a lot of different aspects of business (backorders, new orders, inventory, prices paid, employment, etc.). Such measurements do not tell us the quantity of items being reported. Every manager could report a rise in orders, but if the rise is minimal for all, then it’s not very significant. To see the number over 56 and moving higher is good. We need confirmation of this through a better jobs report (announced on 3/8) and then GDP growth for the first quarter as well.

- New Home Sales at 437,000 Annual Pace, Well Above Expectations… Annual new home sales surged past expectations of around 390,000 and posted the highest number in years.

There is no doubt that housing is important, particularly new housing, because of all the inputs for construction. That is why this number is not a cause for celebration. New home construction was around 650,000 units per year in the early 1990s. The number marched higher and hit a plateau of around 900,000 units per year in the early 2000s. The peak was 1.4 million units in 2005, which then fell to a trough of just over 300,000 in 2011. To have the number now poking above 400,000 is good, but it’s a long way from stoking the fires of employment. At the same time, this number was seasonally adjusted higher far beyond what has been done in previous January reports. There is a distinct possibility that capital gains taking in December 2012 (before tax rates changed) led to a lot of activity in home sales that would naturally translate into home buying in January. This is one month. We’ll see what the future brings.

- Consumer Debt Ticking Back Higher… Remember just a few years ago, when we had a huge debt crisis? Yep, so do I. It might seem logical that, after such a crisis, the last thing anyone would want is, well, debt. That is sort of true, and sort of not. Total consumer debt is actually moving a bit higher, even though mortgage debt (mortgages and HELOCs) is down. In fact, credit card debt is down, too. There is only one category moving up at light speed, student loans. We now have more than $1 trillion in student loans outstanding, while credit card debt is down to roughly $675 million. At this rate, our economy will have twice as much student-loan debt outstanding as we do credit card debt by the end of this calendar year. What’s more, 90-plus-day delinquencies on student loans are now higher (12%) than the same delinquency rate on credit card debt. Exactly how is this supposed to end well?

- Sequestered Budget Cuts Are Here… The two parties could not agree on how to adjust, stop or otherwise amend the sequestered budget cuts that are a requirement of the 2011 debt-ceiling agreement. Per the agreement, the U.S. will face 9% cuts in discretionary spending programs across the board without the benefit of agencies or departments being able to choose what to cut. This is a lot like going to a school and demanding every classroom and administrative department cut 9% instead of simply discontinuing an AP class or a music program. The sequestered cuts are stupid in application, and they are the best we can do, which is sad.

- Tim Geithner to Give Financial Crisis Seminars… Our former Secretary of the Treasury is moving to his next gig. He will lead seminars about financial crises on college campuses. This makes perfect sense. Geithner ran the New York Fed for six years before joining the Treasury Department, so he has intimate knowledge about how to create a financial crisis. This knowledge is enhanced by his time at Treasury where he gave billions in handouts to banks, insurance companies, and union-backed corporations, then demanded that the central bank steal from citizens through the continued printing of new currency which, by way of regulation, all gets handed back to the Treasury for free. I can’t think of a better person to speak on the subject of financial crises. The only thing that would make this better is if he added on a course about how to compute your personal taxes.

- Italian Elections Scare the World… The Italian elections saw the return of Berlusconi, the rise of Bersani and the introduction of Grillo. These three factions have to work out a coalition or else the Italian government will grind to a halt.

It was bound to happen. Eventually one of the euro zone nations of southern Europe was going to see its population strike back. They are tired of bearing the brunt of the payoff for bank failures. They are tired of tax hikes, job losses, benefit cuts and a lot of blabbering out of the European Central Bank about how great things are. We don’t expect this type of voter reaction to stop here. Instead, this should simply be the beginning of the backlash as citizens in other European countries pass judgment at the ballot box in the months and years to come.

- This Week… will be quiet when it comes to economic data reports, but it ends with a bang. On Friday, March 8, the U.S. releases its employment report for February. The trend has been an increase of around 160,000 jobs per month, which is barely enough to keep up with our population growth. We anticipate this report showing a just a touch of strength, but this is before the sequester. Look for unemployment to tick up in the months to come.

Shrunken Paycheck???

How to Deal with Your Shrunken Paycheck in 2013

Reuters – Fri, Feb 15, 2013 11:49 AM EST

NEW YORK (Reuters) – The payroll tax cut quietly expired at the end of 2012, and for many American families who are struggling to keep pace in a tight economy, that has raised questions of what to do.

The tax, which covers Social Security, is deducted from your paycheck automatically. It is based on your income, up to a maximum of $113,700 for 2013. Income above that amount is exempt from Social Security taxes. A tax cut to stimulate the economy shaved 2 percentage points off the payroll tax, but now it has been restored to 6.2 percent.

As a result, you will owe as much as $2,274 in taxes this year that you did not have to pay in 2012.

“You have to put it into perspective: It’s (a maximum of) around $40 a week,” said Robert Pesce, a partner at accounting firm Marcum LLP in New York City. “That is real money, but I don’t know that it warrants panic.”

From a tax perspective, the answer is, you can’t do much. “You can’t opt out of it, and your employer can’t reduce it,” said Tim Speiss, a partner at accounting firm EisnerAmper and head of the personal wealth advisers group.

But from a budgeting perspective, if you need the cash, there are things you can do. Here is how to think about your options:

CONSIDER CHANGING WITHHOLDINGS

Changing your withholdings will not change the payroll tax you owe, but it may help smooth out your tax burden for the year. The Internal Revenue Service’s online withholding calculator (once it’s up and running for 2013 it will be available at (http://www.irs.gov/Individuals/IRS-Withholding-Calculator ) can help you come up with the right number. To change your withholdings, you would file a new Form W-4 with your employer.

If you make $100,000, for example, you will owe $6,200 for Social Security taxes and $1,450 for Medicare taxes, regardless of what you do with your withholdings. At that income level, each additional allowance you take means, very roughly, more than $1,000 more annually in your paycheck – $20 a week – due to lower federal, state and local income taxes withheld.

Be careful if you go this route. Your final tax bill in 2013 depends on your unique financial situation (whether you itemize or take the standard deduction, for example) as well as whether you are affected by the year-end tax changes (such as the new 3.8 percent Medicare surcharge).

If you always get a big refund at tax time – as many taxpayers do – changing your withholdings may be a good way to keep money in your pocket now rather than loaning it to the IRS. For instance, if you got more than $1,000 back last year, and adding one allowance would mean roughly $1,000 back in your paycheck, you could access that money now instead of later. Depending on other changes in your financial and tax picture, however, it is unlikely to shake out quite that neatly.

If you already owe tax in April or received only a small refund last year, however, Pesce warns that he would not advise changing withholdings to add to your paycheck. After all, come tax time, you would have to come up with the extra cash.

“You’re just postponing the problem for later,” Pesce said. “In my experience, dealing with the problems in the moment is better than later on. They get worse later on.”

DON’T CUT YOUR 401(k)

You may be tempted to cut your contribution to your retirement accounts to goose up your paycheck to cover that 40 bucks a week, but it is not generally a smart move. Most Americans are already under-saving for retirement, and trimming what you put in now will have a much bigger impact down the road due to the power of compounding. That is especially true if you receive a matching contribution from your employer and wind up leaving it on the table – essentially walking away from free money.

If you make $100,000, for example, and were putting aside 6 percent in your 401(k) – and your employer was matching at 50 percent up to that level – that’s $9,000 going toward retirement. Cut that savings to 5 percent, and the amount going to retirement falls to $7,500 – or $1,000 less that you would have put in and $500 less from your employer.

Yet you will not see anywhere close to that $1,500 in your paycheck since part of it was from the match and part of it disappears as you lose the tax benefit of saving for retirement.

“Bite the bullet and fund the 401(k) plan,” Speiss said. “You’ve got to figure out a way to make it work.”

RECALCULATE ESTIMATED TAX PAYMENTS

If you are self-employed and owe estimated taxes, the payroll tax cut’s expiration means that you will owe more in tax this year than last, too. To figure out how much, you will need to re-do your estimated tax calculations before making your first quarter payment in April.

The simplest (and most financially conservative) thing: calculate the extra 2 percent you will owe this year, divide it by four, and add that number – an extra $569, if your income is above the Social Security cutoff – to your quarterly estimated payments.

Whether you would rather pay that now or later is up to you. Because of the way the so-called safe harbor rules work, as long as you pay 90 percent of the total tax you owe this year, or 100 percent of what you paid last, you generally will not owe penalties.

TAP DISCRETIONARY INCOME

Ask yourself if you really need the money lost to the payroll tax for living expenses. If the answer is yes, look at your discretionary spending. Can you cut your expenses by eating out less, or by not buying so many cups of coffee during the work day? More important, is your credit card debt weighed down by high fees that you would be better off trying to lower?

Who else wants to be a Millionarie.?

“Who Else Wants To Be A Safe Money Millionaire …

On Your Current Income!”

EXCELLENT VIDEOS TO WAS – ABOUT 5 MINS EACH.- WHERE IS THE ECONOMIC FUTURE GOING???

It is possible to grow wealthy, even during bad economic times,

when you follow a proven blueprint!

Have you ever ... Felt frustrated seeing money disappear in the market?

Concerned that you don’t know where to put your money to keep it safe?

Worried about making ends meet with the high cost of living; kids, cars, homes,

credit cards, bills and taxes?

The book “Safe Money Millionaire” could arm you with the information you need to solve these problems …

However, the book itself can never give you a PERSONALIZED plan to help you

achieve your goals.

For that it takes a more personal approach. That‘s why I’ve been trained as a Safe

Money Millionaire Advisor to create a unique BLUEPRINT. .. just for you so you can get

on the path to becoming a Safe Money Millionaire.

In this no obligation blueprint I could help you discover:

- How to find — on average — $312 per month you are currently wasting (It’s like giving yourself a $3744 per year raise without working any extra hours.)

- A proven blueprint to show you how to create an income you can never outlive. (Imagine knowing you have an income for the rest of your life!)

- 3 ways to protect yourself from the ravages of tax increases! (This powerful strategy is the difference between growing YOUR wealth … or funding Uncle Sam’s spending spree.)

- “The Power Down Pian”: How to payoff all your debt in 9 years or less. (Imagine that wonderful day when you own everything free and clear … including your mortgage.)

- The 117 year old ‘secret’ life insurance and ‘safe money’ financial tools that allow you to keep your money safely out of the market...while growing EVERY YEAR guaranteed.

WARNING: What you are going to discover is NOT what Wall Street and traditional guru’s preach … so be ready for a totally different approach!

If you’re fed up with the roller coaster and want a safe way to grow your wealth … this may be a good option for you. (It’s not for everyone. If it’s not for you, I’ll won’t waste your time or mine, I’ll just let you know and we’ll part friends.)

Remember, there’s no obligation. I’ll be happy to answer your questions and give you a blueprint that could help you solve the biggest concerns and issues in your life today. I think you’ll find it extremely exciting and liberating to see there is some light at the end of the financial tunnel!

Please give me a call at 800-797-1594 and we can create a Personalized Blueprint just for you and your family. James B . Driscoll,

Qualified Safe Money Millionaire Advisor

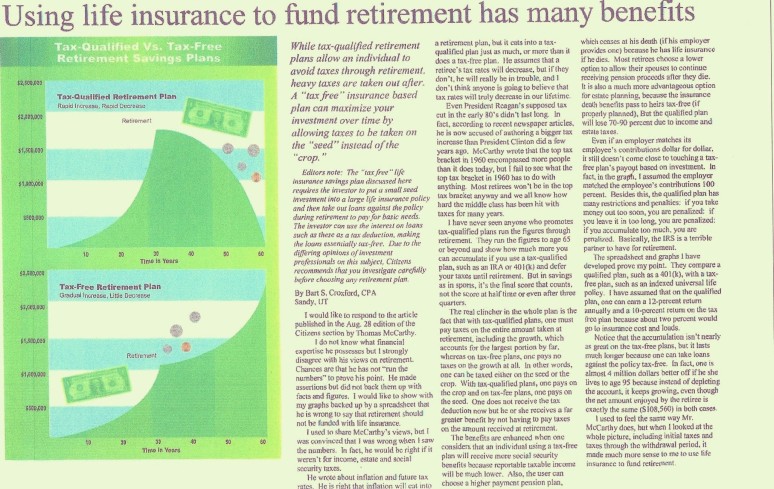

CPA’s say Life Insurance Great Option, Great Returns & Tax-Free Income

Indexed UL – Perfect for the Professionals

Why you should purchase an Equity Indexed Annuity

Why You Should Purchase an Equity Indexed Annuity

James B. Driscoll

Published January 02, 2013

Sometimes, people can be so afraid of being sold something that they strangle their own deductive reasoning. I had a meeting with a handful of our affiliated agents last week. One of the agents said, “Carter, if people actually understood the mechanics of an Equity Indexed Annuity, everyone would purchase one!” I told him he was absolutely correct. If people really took the time with an open mind to think for themselves and analyze the facts, there is no question more people would be preaching the news of Equity Indexed Annuities. Right then, another agent spoke up and said, “The problem is that as insurance agents, people look at us like used car salesmen trying to sell them a car with sawdust in the engine.” The purpose of this article is breakdown some of the misconceptions of annuities, throw a few facts on the chalkboard, and motivate you to think for yourself.

First, let’s begin with your current plan for financial independence and kick the tires of your current nest egg. At this time, I would like you to grab a pen and, either on the back of this article or on a separate piece of paper, answer these questions:

- What are the current fees you are paying to have your money managed? (And I mean everything, not just the “management fee,” but also the administration fees, fund fees, transaction fees and other expense fees.)

- What is the average rate of return and the actual rate of return since the inception of your account? (If you do not know the difference, please stop and read page 41 of “The Retirement Miracle” by Patrick Kelly. The book is available for free on my website at www.pacinsgroup.com.)

- What will your projected Social Security benefit be and what percentage of your nest egg do you plan on spending per year when you retire? (For example, 5%, 10%, 15%?)

- How much of your nest egg are you willing to lose? What guarantees does your current retirement plan have to protect you from market losses when the next crisis hits?

Now, after you look at your answers, if I show you a product that does not charge you a management fee out of your pocket and will have the same average return and actual return; a product with which you can take up to 10% per year with no surrender penalty and gives you upside potential to the market with no downside exposure, would that be something that might interest you?

I feel there are 4 major benefits when it comes to Equity Indexed Annuities.

- Protection against principal loss. Meaning: if the index goes down, you don’t lose a penny.

- The power of the annual reset feature. This allows you to lock in gains every year the index is positive!

- Low or NO management fees.

- Guaranteed income for life (with the guarantee income rider).

At this point you may be thinking, “Well, if this is such an amazing place for me to put my money, why haven’t I heard about it?” This is probably my favorite question people ask, because I get to respond back with, “Where would you hear about such a product?” Wall Street? Nope! Your financial advisor who happens to be under the influence of Wall Street? No! Your CPA? I don’t think so! It is too risky for them to step out on this branch from a liability side because they are not insurance or securities licensed. The point I am trying to make is to look at the facts on the chalkboard! It is not about me, Wall Street, the financial advisor, CPA, or anyone else. It is about what is best for you! What product do you feel suits you best? Sometimes, it’s a variety of strategies depending on people’s risk tolerance.

The biggest fear of retirees is outliving their money. In the past, people could live on social security and interest on their savings because the rates of return were in the double digits. With the current 1% or 2% rates of return, there is a strong possibility that you will have to invade the principal of your savings. This could prove to be catastrophic if you live to long. How much of your savings must you deplete each year to maintain a standard of living that is acceptable to you? Yes, there are surrender charges with annuities, but this typically applies if you take more than 10% per year. How many people are going to spend more than 10% per year of their qualified retirement plan?

In conclusion, where can you get the potential for an inflation-beating return and have 100% protection against market risk of not only your principal, but also of all your previous years of gains? For the past 12 years, our clients have enjoyed the guarantees annuities provide, along with the upside potential of market indexes. Call or email me to set up a free consultation, have a cup of coffee and discuss your personal situation. I look forward to it!

http://www.jamesbdriscoll.wordpress.com

jamesbdriscoll@gmail.com

Tax-Free Income for retirement

Tax-Free Life Insurance: An Untapped Investment for the Affluent

Index Strategy vs. Roth IRA

IUL |

Roth IRA |

|

| Taxed Advantaged Withdrawal |

Yes |

Yes |

| Cap on Contribution |

No |

$4,000/yr |

| Minimum Contribution |

No |

$1,000 |

| Cap on Annual Earnings Allowed For Contribution |

No |

Yes, $95,000 annual income (if you earn more, you can’t contribute) |

| Penalties for Early Withdrawal |

None |

10% prior to age 59 ½ ( soon to be 62 years old ) |

| Guarantee Protection Against Loss of Principle |

Yes |

No |

| Guaranteed Minimum Interest |

Yes |

No |

| Protection from Creditors or Law Suits |

Yes |

No |

| Restrictions on College Assistance |

None |

Must use Roth prior to government assistance |

| Lowers Social Security Benefits |

No |

Yes (counts as income against SS) |

| Restrictions on Medicaid |

(gov. assistance for excessive medical bills)

None

You must completely use up your Roth IRA prior to receiving government assistance

Permanent Life Insurance

Yes

No*

You Pay Management Fees

No

Yes (including loading fees )

Passes to Children Tax Free

Yes

No

* Only 2% of Term policies ever pay out. At the end of the term you must re-qualify for insurance coverage. If anything significant has changed in your health, you may be declined.

Roth IRA $4,000/ year for 30 years at 9.1%

Cash Value after 30 years = $555,505 (did not deduct cost of fees involved )

Annual Cash Flow = $50,550 ( not including penalties if taken out prior to age 59 1/2 )

Cash flow after 20 years = $1,011,000

Index Life Strategy $4,000/ year for 30 years at 9.1%

Cash Value after 30 years = $486,744 ( includes cost of insurance and fees )

Annual Cash Flow = $72,755 ( no penalties if taken out prior to age 59 ½ )

Cash flow after 20 years = $1,455,100

IT’S viewed as an insider’s secret for the affluent: a legal way to invest in hedge funds and other potentially lucrative assets, all without paying taxes on the gains.

Private placement life insurance, as it is known, is still unfamiliar to many wealthy people — and trickier to design properly than even some savvy investors realize, tax lawyers and financial advisers say.

“It sounds so good — ‘I can invest tax-free and get the money’ — but it’s actually very complex,” said Jonathan Blattmachr, a retired estates and trusts partner from the Milbank Tweed law firm in New York.

Private placement life insurance is an investment wrapped inside an insurance policy. The Internal Revenue Code treats the taxation of insurance differently from that of investments, like stocks or hedge funds, and does not levy federal income tax or the 15 percent capital gains on a life insurance policy when it pays out upon the death of the holder. So by stuffing an otherwise taxable investment inside a tax-free life insurance policy, investors can reap the compounded gains of that investment and the death benefit, all tax-free.

The insurance is a form of variable life insurance whose cash value depends upon the performance of investments held in the policy. It is particularly lucrative because hedge funds, which trade frequently, otherwise often carry the 35 percent short-term capital gains tax.

William Waxman, a principal at Waxman Cavner Lawson, an insurance broker for the wealthy and a financial adviser in Austin, Tex., said that demand for hedge funds, even in a down market, “is driving a lot of the private placement insurance market.” Still, he said, the private placement life insurance industry was relatively small; the cash value of all policies outstanding amounts to perhaps $4 billion to $5 billion. While brokers pitched the policies to many family offices on the East Coast, he said, West Coast offices appeared less tapped.

There are other lucrative benefits besides the absence of income taxes.

When structured properly, the gains and the death benefit can escape estate taxes and go to your heirs tax-free when you die. If structured through an offshore entity, like a foreign trust, the gains can remain out of reach of creditors or those who might sue you.

But investors appeared to be shying away from the foreign variant, Mr. Waxman said, in part because “you have very sophisticated estate planning lawyers in the United States, but they don’t necessarily have offshore practices.”

Investors may also be able to borrow up to 90 percent of the gains from the policy without paying taxes on the loan. One exception is when the policy is structured as a modified endowment contract, or M.E.C.; then, the amount borrowed is taxed at ordinary rates, typically 35 percent, and may carry a 10 percent penalty tax.

Investors who buy an M.E.C. version do so solely to pass on the death benefit free of income and estate taxes to their heirs, not to access gains tax-free before then. The Internal Revenue Service considers the policy an M.E.C. if the investor has paid in all the premiums due over the first seven years — a limitation intended to prevent the rapid financing of tax-free benefits.

Investors must also meet several hurdles.

They must be an “accredited investor” and “qualified purchaser” as defined by the Securities and Exchange Commission, which means they must earn at least $200,000 a year and have investable assets of at least $5 million. The insured must qualify medically for an insurance policy — in other words, not hooked up to life support in intensive care.

But tax lawyers say the most difficult hurdle concerns restrictions around the choice of the investments. The “private placement” part means that the investor must be willing to choose, from a list preselected by the insurer, the bonds, stocks, hedge funds or other investments in which premiums will be invested. In other words, you can’t try to stuff in your separate hedge fund investment, a move that can run you afoul of the Internal Revenue Service.

And you can’t stuff in paintings or other valuables, Mr. Waxman added. He said the policies were not good for those wanting to invest in private equity, because the latter can be difficult to convert to cash.

Gideon Rothschild, an estates and tax lawyer in New York who specializes in offshore versions of the policies, said the people who can buy them “are control freaks and tend to think they can invest better than anybody, including the hedge fund manager,” and thus often shy away from them.

Though the policies require only a couple of premium payments, they are hefty. Insurers that sell them typically require at least a $1 million prepaid premium for a $10 million policy, and others require $5 million. Some policies have a value as high as $100 million or more, with the total premiums due ranging from $10 million or more each. Big sellers include MassMutual, the American International Group, New York Life, the Phoenix Companies in Hartford and Boston, Prudential, John Hancock and Crown Global Insurance.

But the various fees that can be owed in addition to the premiums are typically well below fees for other forms of investable insurance.

They can include a one-time sales load charge, a required annual mortality expense, the monthly cost of insurance, a state premium tax and a deferred acquisition cost. If a trust or foreign corporation is set up offshore to house the policy, there are other fees, including one paid to the trustee of the entity that owns the policy.

If the policy owns hedge funds, investors may also be required to pay the typical 20 percent cut of profits and a 2 percent management fee to the fund.

The total fees associated with an onshore policy vary, but Mr. Waxman said that, as a guideline, “we try to make the total cost of the whole thing 100 basis points or less of the cash value” of the policy. (One basis point is one one-hundredth of a percent, so 100 basis points would be 1 percent, or $50,000 on a $5 million policy.)

Lawrence Brody, an estate planning partner at the Bryan Cave law firm in St. Louis, said that “you have to have the financial capacity to buy one of these, so that it’s not too tempting to have a $100 million policy on your life and somebody who’s a beneficiary who might want to kill you” to collect the death benefit. “You will want a billion or so in net worth, and the insurer will probably even require it.”

Nothing like tax-free income. IRS is looking at this real hard.

James B. Driscoll, President Senior Services

1/8/13A_Tax_Free_Retirement

Taken to Task: A Poverty of News, an Embarrassment of Media

Taken to Task: A Poverty of News, an Embarrassment of Media

By James B. Driscoll, 16 hours ago

48 Contiguous States and the District of Columbia % Gross Yearly Income Family Size 25% 50% 75% 81% 100% 133% 175% 200% 250% 300% 1 -$2,723 $5,445 $8,168 $8,821 $10,890 $14,484 $19,058 $21,780 $27,225 $32,670 2 -$3,678 $7,355 $11,033 $11,915 $14,710 $19,564 $25,743 $29,420 $36,775 $44,130 3 -$4,633 $9,265 $13,898 $15,009 $18,530 $24,645 $32,428 $37,060 $46,325 $55,590 4 -$5,588 $11,175 $16,763 $18,104 $22,350 $29,726 $39,113 $44,700 $55,875 $67,050 5 -$6,543 $13,085 $19,628 $21,198 $26,170 $34,806 $45,798 $52,340 $65,425 $78,510 6 -$7,498 $14,995 $22,493 $24,292 $29,990 $39,887 $52,483 $59,980 $74,975 $89,970 7 -$8,453 $16,905 $25,358 $27,386 $33,810 $44,967 $59,168 $67,620 $84,525 $101,430 8 -$9,408 $18,815 $28,223 $30,480 $37,630 $50,048 $65,853 $75,260 $94,075 $112,890More than 49 million Americans, or 16% of the population, were living in poverty in 2010, the government reported this week. Rising poverty is a national tragedy and a brewing humanitarian crisis in America...

The poverty figures released this week came after the U.S. Census Bureau adjusted the way in which it calculates poverty using the new Supplemental Poverty Measure. Instead of just tripling a family’s minimum annual food budget, as previously, this new measure looks at how much families spend on food, shelter, clothing and utilities. You know, life’s basic necessities.

Most groups saw their poverty rates increase using the new calculations, including married couples, whites, Asians, immigrants, homeowners with mortgages, those with private health insurance and the elderly. Poverty rates among those over 65 rose to 15.9% from the previously reported 9%. Poverty rates did, however, drop for Americans under the age of 18, African Americans, renters and people living in rural areas.

I didn’t hear one word about this during the Republican Debate on Wednesday and you probably didn’t hear much about it either, unless you happened to catch former President Bill Clinton make a brief mention of it on The Daily Show with Jon Stewart, who turned it into a joke about the sexual harassment charges being levied at Herman Cain.

It’s Jon Stewart’s job to make light of serious issues, but I’d like to take the rest of the so-called serious media to task for burying this story.

I get that poverty is a depressing topic and a change to how it’s measured is a complicated story to tell. But I’ve never had a viewer tell me they want LESS depth or more ‘infotainment.’

More than ever Americans want news organizations to focus on the hard stuff…instead of the salacious (Victoria Secret‘s runway show), the sensational (Sharon Bialek’s press conference), the sophomoric (Rick Perry’s ‘oops’ gaffe) and the ridiculous (anything about the Kardashians) developments that pass as “news” in our society.

In his brilliant show “The Agony & The Ecstasy of Steve Jobs,” Mike Daisey talks about how working conditions remain brutal at Apple’s Foxconn plant, but we don’t hear about them anymore because of Chinese censorship. If the ‘media echo chamber’ pings for news and doesn’t hear a response, it moves on to the next story, he observers.

In these difficult times, and especially on Veterans Day, it’s important for all of us to be aware of the messages we’re sending to the media in the stories we watch, share, favorite and Tweet about.

Those among us — journalists and civilians alike — who ignore the hard realities of American life and get lost in what should be the minor distractions. You’ve been taken to task.

Again just a short word~to thank all you veterans who have served our country that we might be and keep out free GOD based society and enterprise.